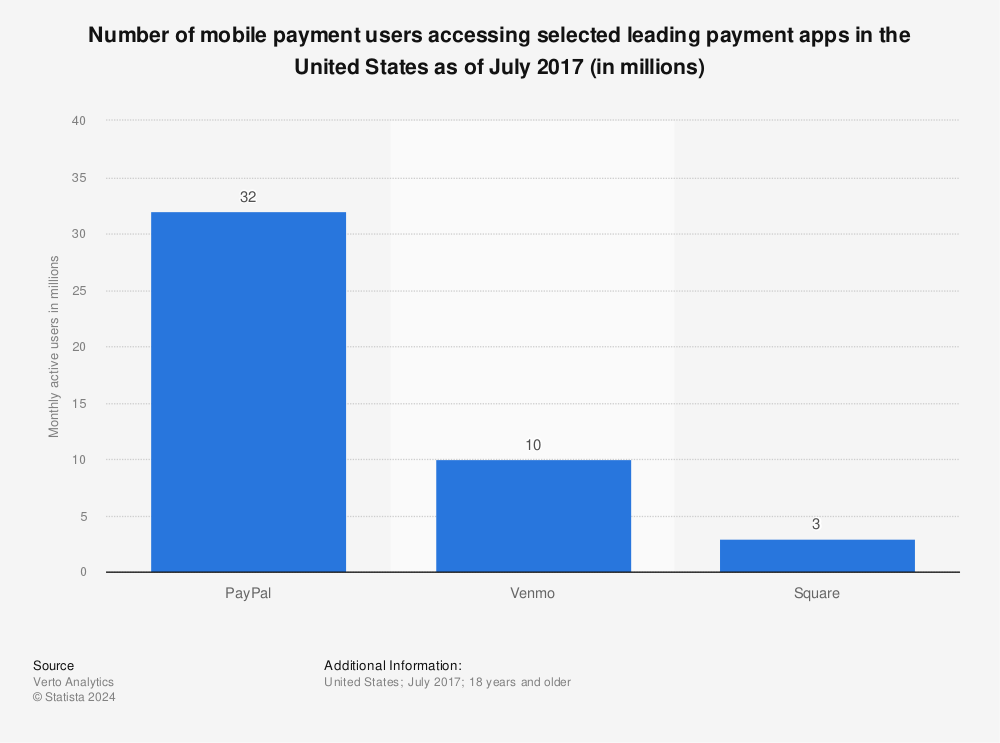

Thanks to the rise of peer-to-peer payment apps, going Dutch has never been easier. Just pull out your phone and ask for their username. But if you count yourself among the few Americans who still don’t trust or understand payment apps, we’re here to demystify one of the industry's most popular companies: Venmo.

What is Venmo?

Venmo is a free peer-to-peer payment app that allows users to send money, pay merchants, and invest in cryptocurrency. What makes Venmo unique is that it also acts a bit like a social network. Users can add friends, share transactions, and react to payments. But more than anything, the PayPal-owned app is a quick way to pay merchants and split expenses between friends, family, and housemates.

How Does Venmo Work?

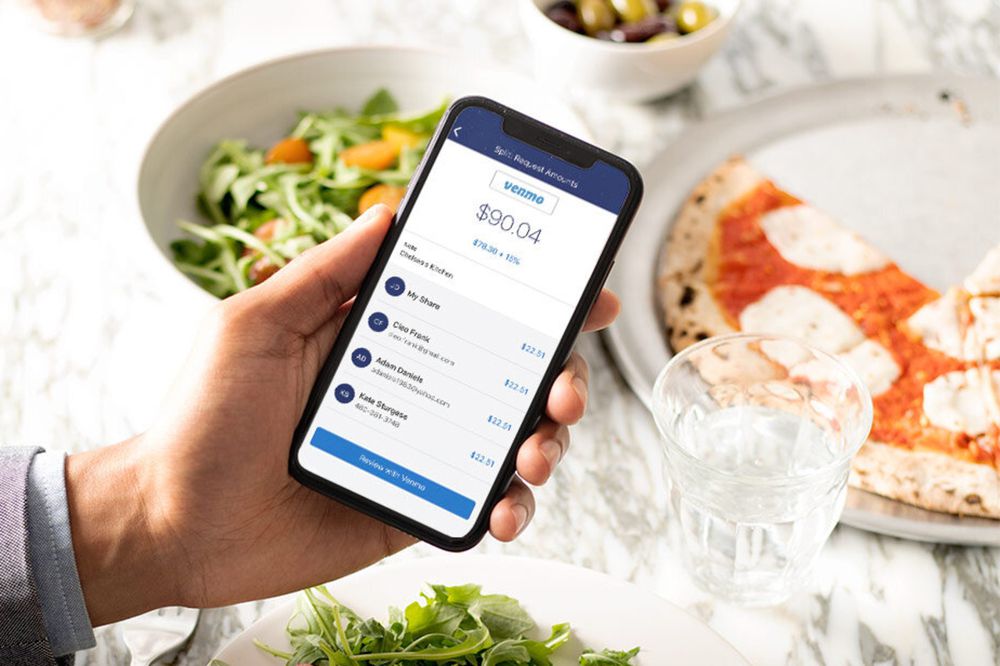

Let’s say you’re at dinner with four friends. Rather than splitting the bill with several cards, you could pay and have your friends Venmo you (yes, it’s a verb) their share.

The money that you receive from other users goes into your Venmo wallet, which you can either leave or transfer to your bank. Similarly, when you Venmo someone, you can pay with money from a linked bank account, debit card, credit card, or your remaining Venmo balance. In that way, Venmo is less of a bank account than a middleman.

How Does Venmo Make Money?

Venmo earns most of its money from transaction fees, though it also invests cash and sells user data.

Investments: Venmo invests some accounter members’ funds in “liquid investments,” according to its user agreement. But consumers won’t see any of this money (hooray!), as Venmo owns “the interest or other earnings on these investments.”

Transaction Data: A USA Today report found that Venmo regularly sends user data to third-party companies, including account holders' locations. In response to the publication's investigation, Venmo’s parent company PayPal said that they use this consumer data “to process transactions, resolve disputes, manage risk and protect against fraud.”

Merchant Fees: When you pay with Venmo, businesses are charged a 1.9% fee plus 10 cents on all transactions. Similarly, companies like Uber that have added a "Pay-With-Venmo" feature to their apps are also charged fees.

Transfer Fees: When Venmo users transfer their funds to a bank, they can either wait three to five business days or pay a 1.75% fee for an instant transfer.

Credit and Debit Card Fees: Venmo also offers its own debit and credit cards, which earn the company money through fees and interest.

Crypto Fees: In 2021, Venmo announced that its users could buy, hold, and sell cryptocurrency using the app. Users are charged fees upwards of 49 cents for buying and selling the digital currency.

Is Venmo Safe?

Sort of. While Venmo encrypts its data and stores it on servers in secure locations, consumers should be clear-eyed about the risks associated with digital payments.

To begin with, Venmo isn’t a bank, meaning that funds you store within the app aren’t necessarily insured by the FDIC or NCUA. So if Venmo goes belly up, you could lose your money, as the Consumer Finance Protection Bureau recently pointed out.

Privacy is also an issue. In 2018, Venmo reached a settlement with the Federal Trade Commission after the federal regulator sued the company for its “privacy and security practices.” One aspect of the suit took issue with Venmo’s claim that it offered “bank-grade security systems,” when the company failed to alert consumers about changes to their passwords, emails, and other account settings.

Nevertheless, Venmo isn’t an outlier in this regard, and in most respects, users shouldn’t expect to have major issues with the company. To the company’s credit, it has received an A- from the Better Business Bureau (BBB) and has been accredited by the organization since 2016.

Here are a few tips you can follow to ensure that you stay safe and avoid Venmo scams:

Set up two-factor authentication.

Add a pin code.

Choose a strong password.

Make your Venmo transactions private.

Don’t use the app on public Wi-Fi.

Always confirm that you’re sending money to the right person.

Immediately transfer leftover funds to your bank account.

The Bottom Line

Now that payment apps have taken over, cash is no longer king. But that doesn’t mean you should blindly trust these companies, most of which aren’t as well-regulated as traditional banks. Rather, savvy consumers should seek to understand these apps, particularly when it comes to keeping their data and money safe.

Other Frequently Asked Questions

Who owns Venmo?

In 2013, PayPal, a subsidiary of eBay, spent $800 billion to acquire Braintree, the company that operates Venmo. Put simply: PayPal owns Venmo.

Is Venmo down?

You can check Downdetector or IsItDownRightNow? to see if other users are experiencing outages.

Can you use a credit card on Venmo?

Yes. You can make payments on Venmo using your account balance, bank account, debit card, or credit card. Credit card payments come with a 3% fee.

How can I cancel a Venmo payment?

You can't cancel Venmo payments. Venmo can only reverse payments if the recipient agrees, their account is in good standing, and they still have the funds available in their account. For more information, visit Venmo’s support page.

Does Venmo have a limit?

Yes. Venmo has personal profile payment limits. Verified accounts can send up to $60,000 a week and spend a combined $7,000 through Venmo-facilitated payments (e.g. using Venmo in Uber). Account holders who haven’t verified their identity can spend $299.99 per week.

For more explainers about tech and finance, please sign up for our free newsletters.

Photo credit: MStudioImages/istockphoto

Photo credit: MStudioImages/istockphoto Photo credit: Venmo

Photo credit: Venmo