Tech companies don’t have your best interests in mind. There’ve been enough privacy settlements, data breaches, and data mining scandals to prove that. It’s normal, then, to wonder if you can trust an app like Rocket Money — one of the highest-rated budgeting tools online. We tried the app ourselves to see how trustworthy it is and if it’s worth using in the first place.

What Is Rocket Money?

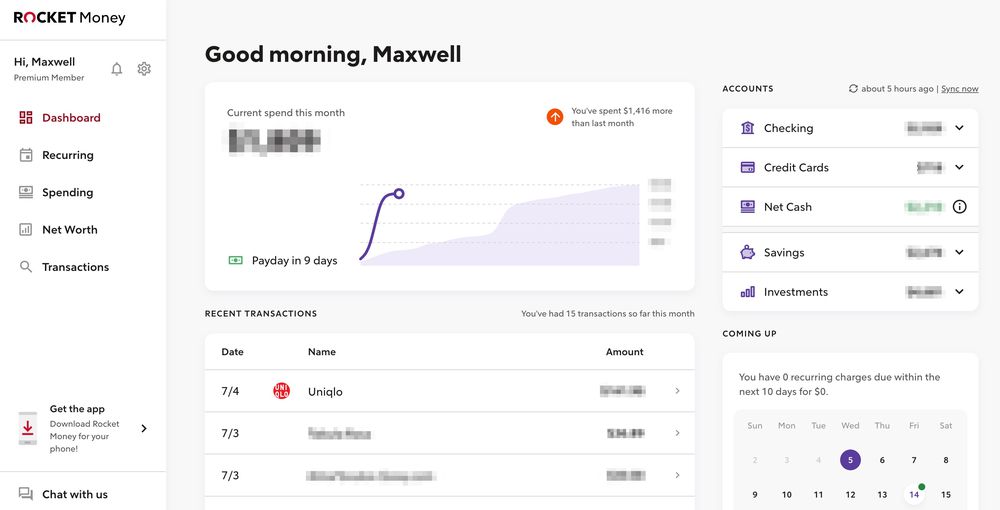

Rocket Money, formerly TrueBill, is an online budgeting app that tracks your spending, income, subscriptions, and savings goals, among other financial metrics. Given that consumers have so many separate things to monitor — student loans, savings, investments, etc. — the appeal is that you can see everything in one place. Rocket Money also advertises a few slick features, such as allowing you to cancel subscriptions without leaving the app. While there is a fully functional free version, users can also choose to pay between $3 and $12 a month, as the company offers a sliding scale. Consumers that pay between $3 to $5 per month will be billed annually.

Features include:

Track and classify your income and expenses

Make a budget

Negotiate bills

Text-based customer support

Monitor your credit score (premium)

View, track, and cancel subscriptions (premium)

Automated “Smart Savings” transfers (premium)

Net worth tracking (premium)

Real-time balance syncing (premium)

What We Liked

Simple User Interface

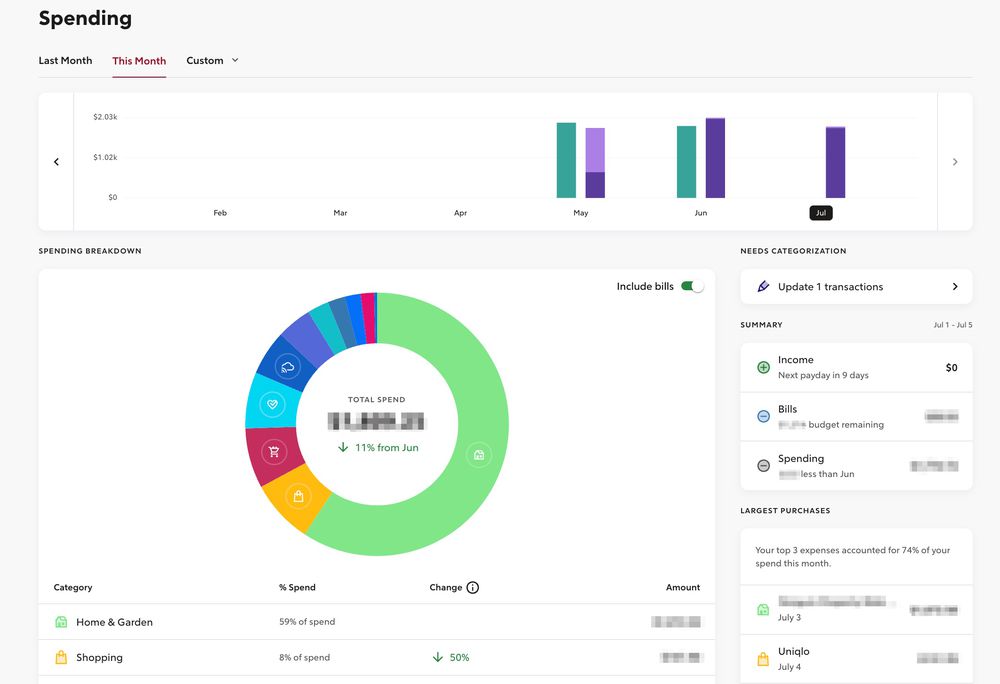

I’ve used the free version of the Mint budgeting app before, and it was clunky, ugly, and plastered with ads for the company’s products. But I found Rocket Money’s user interface both attractive and intuitive. Importing my account data through Plaid, a fintech company that connects financial data to apps, was quick and easy. And I didn’t have to consult a help page or guide to complete more advanced tasks, like classifying my expenses for more accurate budget tracking and ignoring certain charges. Everything flowed naturally.

Robust Free Version

Rocket Money also deserves props for providing a free, functional version of its app. Yes, you miss out on some features — such as real-time bank syncing and credit monitoring — but the core expense tracking and budgeting tools remain available.

Rocket Money also throws in some neat extras like automated bill negotiation. Instead of having to go through nine rings of call center hell, you can press a button and have Rocket Money do the heavy lifting. If the company succeeds in saving you cash, they’ll take 40% of your savings as payment — or so it says. In practice, consumers say that the negotiation feature is one of the app’s weakest features.

Helpful Support

Rocket Money only offers text-based customer service via chat or email, which could be a dealbreaker for some. That said, I found the agents I messaged coherent and helpful, though responses can take up to a day. Premium members get priority customer support.

What We Didn’t Like

Problems With Plaid

The biggest issue I had with Rocket Money was that there were gaps in my transaction data. When I reached out to support, they explained that they couldn’t do anything about it. The problem, they explained, lies with Plaid, the digital middleman between Rocket Money and external accounts. While this gap only applied to past transactions, it was frustrating not to have historical data to help make a budget.

Limited Desktop Features

If you want to make a budget, you have to use Rocket Money’s mobile app. As someone who prefers to work on a larger screen, I found this profoundly frustrating. But once you’ve created your budget, you can access it (along with other features) via the desktop site.

Tweaking Required

If Rocket Money hadn’t been easy to use, then I would have bailed on the product a lot sooner. That’s because you have to make tons of tweaks and changes to actually use the app. Budget at least an hour to change misclassified purchases, make rules for certain transactions, and hide interbank transfers that appear as payments. However, once you’ve dialed it in, the app is excellent for monitoring your money.

Cancellations Don’t Always Work

Automating subscription cancellation with a press of a button is a great idea, but consumers should be aware that the feature doesn’t always work. When I tried to cancel a pesky recurring Peacock subscription, Rocket Money informed me that it can’t “due to security restrictions.” Canceling Paramount+ worked, however.

For more in-depth reviews, please sign up for our free newsletters.

Is Rocket Money Safe?

It’s not easy to answer this question with a yes or no.

According to Rocket Money, the app uses “bank-level” 256-bit encryption to protect your data, which it stores on Amazon Web Services (AWS) servers.

As we’ve mentioned, the company also partners with Plaid to connect your Rocket Money account to banks and other financial services. “Your credentials are sent through Plaid to your bank or credit card provider. Plaid then sends back an encrypted token to us which provides access to your transaction data. We cannot make any changes to your account,” Rocket Money’s website reads.

But the fact remains that you’re still trusting these companies with massive amounts of personal data. And they make mistakes. Last year, Plaid settled a $58 million class action lawsuit that claimed the company had sold consumers’ data without their permission.

Rocket Money Reviews: What Consumers Think

Most Rocket Money users on Reddit’s personal finance forum praised the app, with multiple commenters writing that it is better than Mint. However, some users complained about the negotiation feature. One Redditor writes that when they tried to lower a bill, Rocket Money charged them the 40% negotiation fee even after their bill went back up to the normal rate. “I ended up losing a couple hundred dollars,” they added.

TLDR: Pros and Cons

| Pros | Cons |

|---|---|

| See your transactions in one place | Plaid doesn’t always import all transactions |

| Easy-to-use interface | Can only create a budget on mobile |

| Helpful text-based support | Have to tweak a lot of misclassified transactions |

| Cancel subscriptions with the press of a button | Cancellation feature doesn’t always work |

| Can have Rocket Money negotiate bills for you | Consumers say negotiation tool doesn’t work well |

| Free version available | Have to trust Rocket Money and Plaid with your data |

How Rocket Money Compares

Of course, Rocket Money isn't the only budgeting app out there. Although we won't go into an in-depth comparison, the table below provides a diverse overview of the program's biggest competitors. Whereas some might prefer a more hands-on, zero-based budgeting app like YNAB, others will enjoy Fudget's old-school simplicity.

| Rocket Money | YNAB | Mint | Fudget | |

|---|---|---|---|---|

| Best for People Who Want: | An easy-to-use budgeting solution | A zero-based budgeting program | A free, no-frills budgeting tool supported by ads | A basic budgeting app that doesn't share your banking data |

| Key Features | • See snapshot of income, expenses, and net worth • Negotiate bills • Cancel subscriptions | • See snapshot of income, expenses, and net worth • Allocate every dollar of your income to expenses and savings • Budget far in advance | • See snapshot of income, expenses, and net worth • Access credit score for free | • Manually log income and expenses • Budget on multiple devices in real time |

| Yearly Cost | Free - $36/year | Free - $99/year | Free | Free - $20/year |

The Bottom Line

If you’re looking for an easy-to-use budgeting tool, Rocket Money is a good choice, especially if you’re content with the free version. Thanks to its robust monitoring and budgeting features, it will save you money — provided you stick to your savings plan. But it’s not for everyone. Consumers who prefer zero-based budgeting should look at YNAB or Goodbudget instead. And if you’re weary about sharing your banking data with third parties, then you might consider Fudget or a simple excel spreadsheet.

Frequently Asked Questions

What is Rocket Money?

Rocket Money, formerly TrueBill, is an account monitoring and budgeting app, which offers both free and paid versions.

Does Rocket Money cost money?

While the free version is truly free, Rocket Money also offers a premium subscription with additional features.

Is Rocket Money safe and legit?

Yes and no. The company seems to do its best to keep your data safe. But even then, consumers should be aware that Plaid, which works with Rocket Money, has been criticized for sharing user data without consent.

Is Rocket Money insured by the Federal Deposit Insurance Corp. (FDIC)?

The FDIC insures bank accounts, not budgeting apps. However, Rocket Money's automated savings feature, which automatically allocates money to a Smart Savings account, does use a U.S. bank account that is FDIC insured.

Is Rocket Money free?

Rocket Money offers free and paid versions of its tool.

How do I cancel Rocket Money?

To cancel a premium subscription, click the “Settings” icon on your dashboard and select “Premium.” Scroll to the bottom of the page, tap modify, and then drag the slider to $0.

What was Rocket Money called before?

The app was called TrueBill until Rocket Companies acquired the service for $1.275 billion in 2021.

If I have Rocket Mortgage, do I get Rocket Money Premium for free?

Yes. Rocket Mortgage clients have access to all of the tool’s features for free.

How can I contact Rocket Money?

Rocket Money does not offer phone support. You can contact customer service via email at support@rocketmoney.com or chat. The support team is online Monday–Friday, 9 a.m.–8 p.m. EST.

Photo credit: Cheapism

Photo credit: Cheapism Photo credit: Cheapism

Photo credit: Cheapism Photo credit: Reddit

Photo credit: Reddit Photo credit: Reddit

Photo credit: Reddit