Credit for the (Very) Comfortable

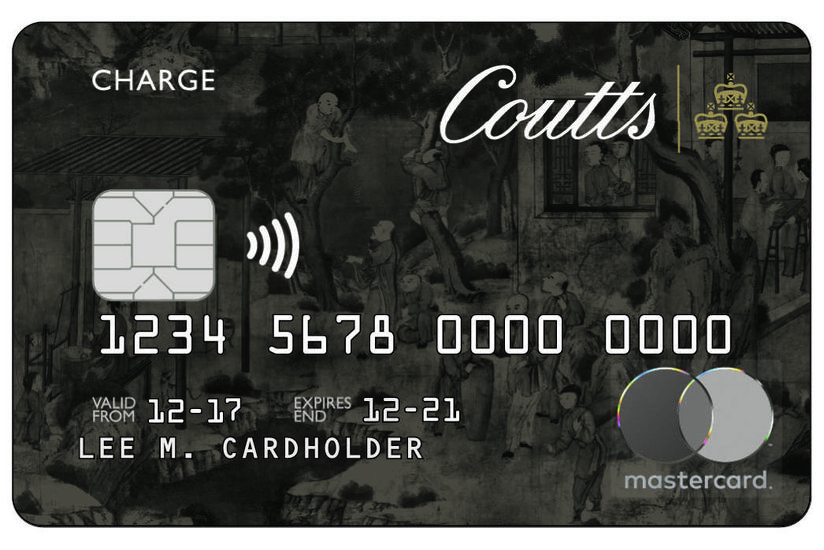

For most of us, credit cards are merely a tool to make ends meet or perhaps a way to pay for splurges. But for the ultra-wealthy or those with stellar credit scores, credit cards are a status symbol that’s part of one’s overall image. Many of the exclusive cards available to members of this elite club are often made from precious metals, while others come with a variety of drool-worthy perks (including concierge services and access to VIP lounges around the world). Want a glimpse at how the other half lives? Read on for a peek at some of the most prestigious credit cards available and what makes them so special.

Editors' Note: A previous version of this story quoted Patricia Russell, who identified herself as a certified financial planner. She is not. Information attributed solely to her has been removed from the story.

Related: Don’t Miss Out on These 37 Credit and Debit Card Perks