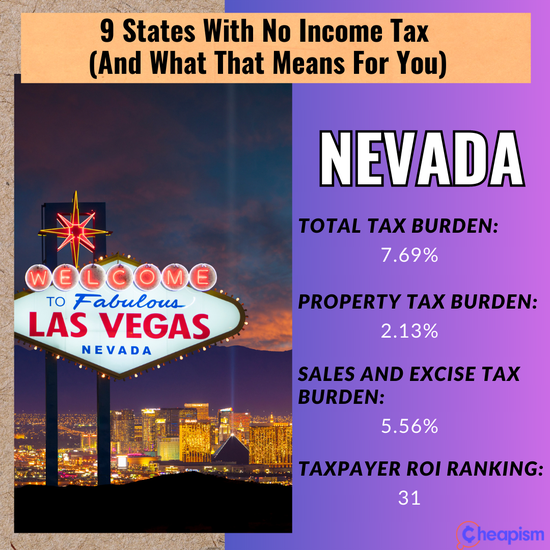

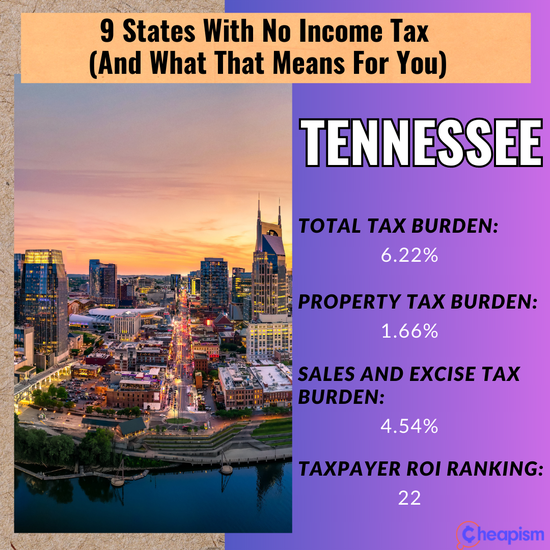

If you live in a state like California or New York, you might be shocked to learn that some states don’t charge income taxes. Sounds like a dream, right? But before you start packing your bags, it’s worth clearing up some misconceptions. To begin with, you’re still going to have to pay taxes on property, goods, and services. And secondly, states that don’t charge income taxes suffer from other problems, like high sales-tax rates and underfunded public services, both of which hurt low-income Americans. Rather than glossing over those details, we’ve contextualized our list of income-tax-free states by including metrics from WalletHub such as overall tax burden and taxpayer return on investment.

Note: The taxpayer ROI ranking referenced in each slide is based on the state's placement among all 50 states, with 1 being the best.